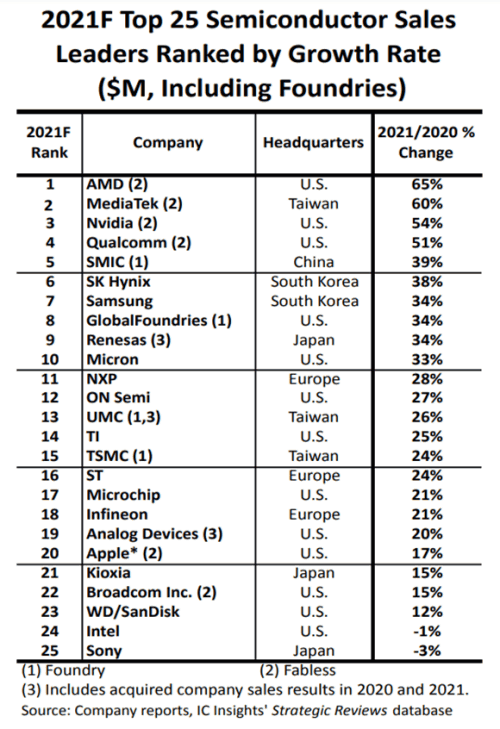

Included in IC Insights’ November update to The McClean Report were several year-end forecasts for semiconductor sales, capex, and a ranking of top sales leaders. Among the data was a projected ranking of the top 25 semiconductor suppliers ranked by sales growth rate.

The semiconductor market is forecast to increase 23% in 2021, fuelled by changing habits caused by the COVID-19 pandemic and the subsequent economic rebound from it in 2021. A strong 20% increase in semiconductor unit shipments, coupled with a 3% increase in the total semiconductor average selling price (ASP), is driving this growth. An increase of 23% would be the largest gain in the global semiconductor market since 2010 when semiconductor sales soared 34% following the financial meltdown and global recession in 2008 and 2009.

A great majority of semiconductor companies – led by AMD, MediaTek, Nvidia and Qualcomm – have been riding the wave of strong market growth this year. These four fabless companies are deeply entrenched in the race to provide leading-edge IC solutions for artificial intelligence and machine learning applications, and 5G smartphones/infrastructure systems.

The accompanying table shows that AMD is expected to top the list with sales growth of 65% for 2021. The company has been firing on all cylinders with market-share gains in many segments, but particularly in processors used in data centre servers, where it has emerged as a leading supplier in this booming market. In addition, AMD is serving mass markets for consumer PCs and game consoles.

IC Insights believes fabless MediaTek is on track to post revenue gains of 60% for 2021. MediaTek’s chips are found in some of the biggest brands of smartphones, TVs and voice assistants, as well as in Chromebooks, fitness equipment, Wi-Fi routers and many other systems. MediaTek has established itself as a leader by providing 4 nm-based 5G technology in its chips for these applications. Throughout 2021, MediaTek increased its output of networking ICs to meet strong market demand and to help offset falling sales of mobile SoCs in 4Q21.

Nvidia is expected to post revenue growth of 54% in 2021. Nvidia was a pioneer in graphics processing units, or GPUs, that make video games more realistic. Since then, the company has expanded into artificial intelligence chips used in supercomputers, data centres, for drug development, weather and long-term climate change forecasting, and in driverless cars. Its chips are also widely used in Bitcoin mining applications. In 4Q21, a new growth driver emerged for its processors: the metaverse, an immersive, next-generation Internet platform.

Qualcomm is the biggest maker of chips that run smartphones. IC Insights forecasts its 2021 IC sales will jump 51%. Even though Qualcomm is the world’s leading smartphone IC supplier, it is trying to reduce its dependence on smartphones and transition into higher-growth opportunities in automotive, wireless home broadband and industrial applications. In its most recent quarterly earnings outlook, Qualcomm gave an upbeat sales forecast for the next few years, fuelled by growth in these new markets.

Combined, these top four growth companies are expected to increase their sales from $54,8 billion in 2020 to $85,4 billion in 2021, a surge of 56%. Amazingly, the forecasted combined sales increase of $30,6 billion by these four companies would represent 31% of the $97,4 billion increase expected for the total worldwide IC market in 2021. Furthermore, it should come as no surprise that the major foundries (TSMC, UMC, GlobalFoundries and SMIC) producing the ICs for the fabless companies are also forecast to register strong sales gains.

Of the 25 largest semiconductor companies, IC Insights forecasts 10 will increase their semiconductor revenue by more than 30% for 2021 and 23 are expected to post double-digit gains. Probably the biggest shock, however, is that during a year when global semiconductor sales are forecast to rise 23%, semiconductor revenue at Intel – the world’s second largest semiconductor supplier – is forecast to decline by 1%, while Sony, the world’s 18th largest semiconductor supplier, expects to post a revenue decline of 3%.

One problem for Intel in 2021 was the ongoing strain on IC supplies, which limited laptop computer sales. Intel says its partners have been unable to source enough components to build as many laptops as they’d like, which has reduced orders for Intel CPUs. Meanwhile, Intel’s newly established IFS (Intel Foundry Service) group shipped its first wafers for revenue in 3Q21. Intel is betting mightily on its foundry service group becoming a critical part of its future sales. Shipping customers’ chips for revenue is an important first step in that process.

A similar story is behind the sales decline forecast at Sony. Shipments of Sony’s PS5 game console did not meet targets in 2021 largely because of chip shortages due to the effects of COVID-19 infections in Southeast Asia. With fewer consoles shipped, fewer game-console processors are needed. In 4Q21, Sony revealed it was in talks with TSMC to produce computer chips in Japan to ensure a steady supply.

© Technews Publishing (Pty) Ltd | All Rights Reserved