The encouraging second quarter 2009 results from the top 20 semiconductor producers indicate that the semiconductor industry is continuing to move through a silicon cycle very quickly on its way to recovery, according to IC Insights.

Recent and near-future market performance can be summarised as follows:

* 4Q08 — the beginning of the downturn/collapse.

* 1Q09 — the bottom of the cycle.

* 2Q09 — inventory replenishment phase.

* 3Q09 — seasonal increase in demand.

* 4Q09 and beyond — market growth will mirror the health of the worldwide economy and electronic system sales.

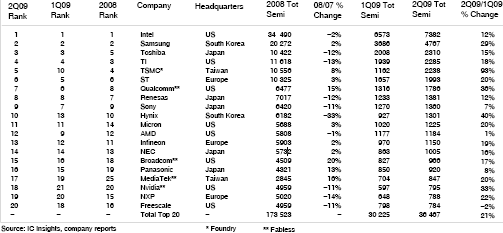

Over the past few years, much has been said regarding the maturing of the semiconductor industry and less volatile cycles. However, IC Insights’ new mid-year update to The McClean Report shows that the trend toward a less volatile semiconductor market does not apply when looking at the industry on a quarterly basis. As shown in Table 1, the top 20 semiconductor companies, in total, registered a 2Q09/1Q09 sales increase of 21%. This was a 37-point swing compared to the 1Q09/4Q08 results when these same top 20 suppliers endured a sales drop of 16%.

Much of the semiconductor sales surge in 2Q09 was due to inventory replenishment after the severe cutbacks of 4Q08 and 1Q09. However, seasonal demand for electronic systems is forecast to drive 3Q09 semiconductor sales up by at least another 8%. IC Insights continues to forecast a 17% decline for the full-year 2009 semiconductor market (the same forecast it presented in December of 2008). Spurred by the bottoming of the worldwide economy from global recession in 1Q09, the semiconductor market is forecast to continue along its recovery path in the second half of this year and gain further momentum in 2010.

Climbers

TSMC – the world’s largest IC foundry almost doubled its sales in 2Q09. In fact, all of the four major pure-play foundries (TSMC, UMC, Chartered, and SMIC) registered very strong 2Q09 sales. TSMC is expecting another 20% increase in sales in 3Q09. Moreover, the company raised its 2009 capital spending budget from $1,9 billion to $2,3 billion, which is good news for the struggling semiconductor equipment suppliers. Considering that the company only spent $390 million in the first half of 2009, a huge jump in spending (to $1,9 billion) is scheduled for the second half of this year.

Hynix – one of the world’s largest memory suppliers, Hynix displayed a 40% sales surge in 2Q09/1Q09 and replaced AMD in the top 10. The company cited rebounding average selling prices (ASPs) for both Flash memory and DRAM as a key boost to its sales figures. Memory ASPs are expected to continue rising in the second half of 2009 and beyond as the severe cutbacks in memory capital spending and facility closures further restrict available capacity.

MediaTek – high-flying fabless IC supplier MediaTek joined the top 20 ranking by jumping six positions in 1Q09. As shown, the company moved up another two spots, to number 17, in 2Q09 with a 20% jump in sales. The company continues to attribute much of its success to the ‘stay-at-home-economy’ driving digital TV IC sales, as well as continued strength in its core wireless communications business.

Descenders

AMD – the second-largest MPU supplier in the world has continued to find that it is no fun to be in competition with the giant Intel. As shown, the company fell out of the top 10 in 2Q09 by barely growing (+0,6%) while Intel increased its sales by 12%. Moreover, AMD’s guidance for 3Q09 was uninspiring, saying that it expects its sales to be 'up slightly' from 2Q09.

Freescale – Freescale dropped from being ranked 16th in 2008 to 18th in 1Q09 to 20th in 2Q09 and was one of only two top-20 companies (along with Fujitsu) to register a 2Q09/1Q09 sales decline (-2%). The company is in the midst of a major reorganisation (eliminating its cellular phone business) and its fortunes are increasingly influenced by the health of the automotive industry.

Fujitsu – Fujitsu dropped from being ranked 17th in 1Q09 to 22nd in 2Q09 (Nvidia replaced Fujitsu in the 2Q09 top 20 ranking) as its 2Q09/1Q09 sales declined by 9%. The company stated that its Flash memory and automotive device sales suffered the most in 2Q09. However, Fujitsu believes that its customers’ excess device inventories have now been depleted and that consumer demand is picking up.

For more information visit www.icinsights.com

© Technews Publishing (Pty) Ltd | All Rights Reserved