The analog IC market in 2011 witnessed the same ups and downs as the overall semiconductor industry. Sales were hindered by poor consumer demand from the US and Europe throughout much of the year, thanks primarily to fears arising from the Euro sovereign debt crisis.

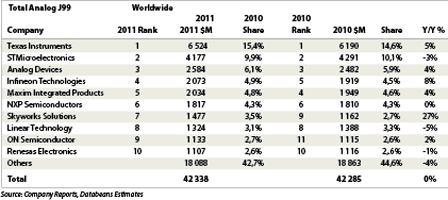

At the same time, automotive sales rebounded across the globe starting in the third quarter of 2011, and industrial manufacturing has rebounded as of the end of the year and should provide a needed boost to analog suppliers during the first half of 2012. As a result, total global analog revenue remained nearly flat from 2010 to 2011, reaching $42,3 billion for the year as a whole.

Texas Instruments, the dominant leader in the market for analog ICs, ended the year with a slight increase in year-over-year (Y/Y) sales, growing 5% to $6,5 billion. This was despite the fact that the company closed out its fourth quarter with a 68% drop in profit compared to the fourth quarter of last year. This was the result of weak demand, restructuring charges related to the planned closures of two older 150 mm fabs (in Hiji, Japan and Houston, Texas) and the costs associated the company’s acquisition of National Semiconductor.

National Semiconductor was officially closed in September 2011 and was rebranded as TI’s Silicon Valley Analog (SVA) division. Specifically, the company witnessed the greatest declines in its high-performance analog (HPA) division, while HVAL and the newly acquired SVA business also declined. Even so, the company’s fourth quarter earnings per share and quarterly revenue both came in above analyst expectations. Heading into 2012, TI is poised to jump on returning consumer demand, as it possesses the strongest manufacturing capability in the analog industry thanks to its acquisitions.

STMicroelectronics, Europe’s top chipmaker, finished out the year with a slight sales decline from 2010, reaching nearly $4,2 billion in analog sales, a decline of 3% from the prior year. This was due largely to the significantly weaker revenue performance from ST- Ericsson, its wireless chip joint venture with Ericsson.

ST-Ericsson, which is yet to be profitable since its formation in 2009, continued to struggle as it made the shift to a new product portfolio. STMicroelectronics also suffered from poor demand in Europe throughout the second half of the year. The firm posted a total net loss $11 million in Q4 2011, compared with net income of $219 million one year earlier. Still, this weakness has been offset somewhat by strong sales in ST’s industrial segment.

Analog Devices, the third largest analog supplier by sales, saw its fourth quarter results declined, much like the rest of the semiconductor industry, and particularly in its industrial and communications markets. Even so, during this period, its consumer and automotive sectors showed strong sales. Also, according to the firm, for the full year, it delivered record annual revenue and profitability. AD’s total analog revenue grew 4% year-over-year to $2,6 billion.

Meanwhile, Infineon, a top analog supplier to the automotive industry, had a strong 2011 thanks to its presence in the premium vehicles of several German and Korean car makers. Infineon continues to capture major design wins in this space. For example, at end of September, both Hyundai and Kia Motors selected Infineon as a supplier of power modules for their current hybrid vehicle models. For the inverter these models now utilise Infineon’s HybridPACK1 power modules. Each hybrid car typically uses two of these power modules.

Infineon’s total analog revenue grew 8% from 2010 to reach nearly $2,1 billion in 2011.

Maxim, meanwhile, rounded out the top five analog suppliers in 2011 with 4,8% market share and just over $2 billion in total sales, which was an improvement of 4% from 2010. Even so, the company slipped one spot in the rankings to Infineon. Much like other firms, Maxim’s wired communications and computing market were down due to overall industry weakness. However, sales of ICs for mobile phones and smart meter revenue, driven by market share gains in China, performed well for the firm throughout most of the year.

NXP Semiconductor ended the year as the sixth largest analog supplier with $1,8 billion in revenue and 4,3% share. Meanwhile, Skyworks Solutions, a supplier of RF and mobile communications systems, witnessed significant growth in 2011 thanks to the industry’s recent move towards higher-end mobile phones with multiband communication. In fact, Skyworks’ share of the total analog market grew 27% in 2011 to reach nearly $1,5 billion, as the firm benefitted from strong demand for smartphones and tablets. As a whole, the company witnessed an impressive 32,4% revenue growth for its 2011 fiscal year.

Linear Technology followed as the eighth largest analog supplier by sales with $1,3 billion and 3,1% of the 2011 market. This was a slight decline of 5% from 2010 revenue, most likely due to a poor fourth quarter in which Linear’s revenue fell by 23% to $294,3 million. Even so, the company is heading into 2012 with a greater emphasis on the wireless networking market, as exemplified by its recent acquisition of Dust Networks, a major provider of low-power wireless sensor network technology. According to Linear, the acquisition of Dust Networks will enable it to offer a complete high-performance wireless sensor networking solution.

ON Semiconductor managed to break into the top 10 of analog suppliers in 2011 with sales of $1,1 billion and 2,7% market share. The firm was able to move up into the top 10 thanks particularly to stronger automotive sales. Also, the company managed to increase its overall semiconductor revenue by approximately 49% from 2010, due to its high-profile acquisition of SANYO Semiconductor, a leader of optoelectronics and other ICs for the consumer segment.

Finally, Renesas Electronics rounded out the top ten suppliers of analog semiconductors with just over $1,1 billion in sales and 2,6% of the supplier market share. This was despite the difficulties that the firm faced throughout much of the year, stemming from the production issues that occurred after the March 2011 earthquake in Japan. In fact, Renesas was among the players worst affected by the disaster.

For more information visit www.databeans.net

© Technews Publishing (Pty) Ltd | All Rights Reserved