Smart metering of electricity, gas and water consumption is playing a vital role as utility companies seek more accurate, granular and timely data to operate their businesses more efficiently and address the need to manage increased demand for applications such as charging electric vehicles. At the same time, the energy industry is being transformed by the need to reduce its environmental impact. This is seeing increased two-way traffic as buildings become energy generators from renewable sources such as solar and wind.

Utilities therefore need to gather and analyse data not only on consumption but also on generation and balance this with expected demand from across the grid.

The richness of meter data, and crucially its transmission, is enabling electricity grids to avoid brown-outs, in which electricity availability becomes constrained, as well as identification of frauds and wastage. In the water and gas industry, meter data is similarly being used to identify leakage and frauds and to enable more accurate billing and charging.

The core application of a smart meter continues to be simply the metering, the accurate counting of what has been consumed. However, adding smartness to meters enables utility companies to provide additional value to customers and partners, rather than retrospectively counting consumption for reporting purposes. It is this smartness that gives the meter the potential to become a hub for other appliances and services in the home and to generate additional revenues for utility companies.

Going global in a fragmented market

By their nature, smart meter deployments are high-volume activities that take time and resources to roll out. Typically projects occur within countries due to the fragmented nature of the utilities market along national lines. However, to achieve economies of scale, utilities companies and metering service providers are looking to create standardised, global devices. These need to take account of both national utilities regulations and communications regulations, making it impossible to manufacture a single, global device but allowing for regional variants to be created, or variants that can be easily configured for national usage.

Smart meter deployments have been underway across the globe for many years with many millions of devices already deployed. Substantial and sustained further growth is expected. Before the pandemic, IoT analyst firm, Berg Insight, had predicted that annual shipments of smart energy meters in Europe alone would reach a record level of 34,8 million units in 2021 while ABI Research reported that penetration of smart electricity meters had reached nearly 70% of households in China by the end of 2019.

However, the pandemic has had an inevitable impact on the deployment of smart meters, to the extent that ABI Research projects a 25% year-on-year decrease in annual smart meter shipments in 2020, with revenue expected to have contracted by 31% – a decrease of $3,3 billion to reach a total of $7,39 billion. However, smart meter shipments and revenues are set to bounce back in 2021 with a 36% growth in annual shipments and revenues exceeding $9,5 billion, the firm has predicted.

The value of smart meter data and the connectivity infrastructure is well understood and underpins utilities’ significant investment commitments.

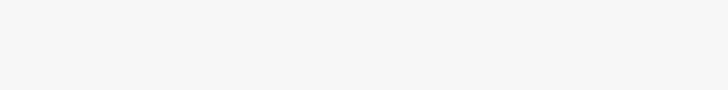

Cumulative investment in advanced metering infrastructure (AMI) will rise to $127,6 billion by 2025, up from $97,4 billion in 2020, according to Wood Mackenzie Power & Renewables. Over that period, total smart meters deployed will rise from about 1 billion to nearly 1,3 billion.

As shown in Figure 1, Asia will dominate the market with roughly 40% of all new meters deployed by 2025, or more than 136 million units, driven by nationwide deployments in Japan and South Korea, as well as expected growth in the still slow-moving market in India. By 2025, about 850 million smart meters will be installed across Asia, including 640 million in China, which largely completed its first-generation AMI rollout last year, along with 82 million in Japan and 22,5 million in South Korea, the firm reports.

India, with about 300 million potential metering endpoints, is expected to be the second largest market behind China, though it hasn’t yet met its own expectations for AMI deployments, with only about 7,7 million meters deployed as of 2019, says the firm.

The challenging deployment landscape

The metering device itself is just one of the challenges involved in smart meter roll-outs. By definition, a smart meter must be connected so it can transmit data and therefore the connectivity is a mission critical requirement. There is no single correct answer to the question of which network technology to use to connect smart meters because each deployment has different characteristics. The array of technologies used extends from the private radio mesh networks of the utility companies to low-power wide-area (LPWA) technologies such as LoRaWAN and Sigfox and then on into the cellular market with narrowband-IoT (NB-IoT) and LTE-M. 2G cellular also exists and is still being used in many markets.

In spite of the disparity, metering organisations are looking to focus in on a limited number of connectivity options and NB-IoT and LTE-M are set to lead the cellular metering market. The connectivity decision is increasingly based on the cost, security, coverage, power usage and the potential throughput of the connectivity. Each of these can cause deployments to succeed or fail and therefore must be carefully balanced against each other to create an optimal solution.

From a coverage perspective, near total national coverage is needed which can also reach meters in difficult locations such as underground in basements or plant rooms of large buildings. More than one connectivity solution may be required to achieve this nationally so different versions of meters may be needed.

This is sub-optimal but necessary for ensuring total coverage.

Capacity is also becoming more of a priority as utilities recognise that they will need to communicate more data and their partners will also increase traffic over meter connections. There’s a fine balance between provisioning a solution with enough capacity to meet future needs and not spending excessively on capacity that isn’t required. Utilities are carefully assessing what the operational landscape will look like in a decade and accordingly, are specifying connectivity that enables them to scale up flexibly in future.

Another constraint is battery life. With lifespans of two decades or more, utilities need meters that are power efficient. A truck roll to replace a battery represents a cost that breaks the profitability of a service, so low-power solutions that still enable the data that utilities and their partners need to be transmitted are attractive.

Why cellular?

In the past, every metering company that offered connected meters had their own proprietary radio frequency (RF) mesh to enable communications. While these solutions worked adequately, they required meter companies to build their own networks and dedicated equipment. With cellular data pricing coming down and the scale of metering projects going up, the cost of the module and the whole device with cellular connectivity is coming down. That makes it very attractive for metering deployments, especially because cellular connections come with built-in security, an important requirement given the potential for frauds in the utilities sector.

Although a range of connectivity options are available to serve smart meters, cellular LPWA networks have a series of advantages to bring to smart meter deployments. LPWA was included in the 3GPP standard Release 13 for machine-to-machine type of communications (mMTC) where these devices don’t have to be connected all the time. This is particularly relevant to the metering space because these devices wake up once in a while, once or twice a day for example, to report data. However, there are scenarios in which some devices communicate more frequently, such as in case of an emergency or an anomaly. In addition, with use cases from other appliances utilising smart meter infrastructure, communication may need to happen more often.

Power saving mode (PSM) and extended idle discontinuous reception (eiDRX) capability was therefore put in place to get the best power out of the cellular connectivity. Power consumption has come down significantly to make 10, 15 or 20 year deployments possible. These were not possible prior to Release 13 when PSM and eIDRX features didn’t exist with Cat-1 and above categories.

Now attractive chipsets and modules achieve power consumption that is as low as a microcontroller unit (MCU) can get. Thanks to the ubiquity of network coverage, the security and the low power usage, cellular is becoming the preferred connectivity mode for smart meters and there’s a big effort from the cellular carriers to encourage adoption because meters become an additional revenue stream for them.

The Quectel BC660K-GL

Based on the latest chipset from Qualcomm, Quectel’s new BC660K-GL module has been designed to meet the needs of the smart metering industry. The module offers low power consumption which is vital for deployments that expect to operate for 15 or 20 years without being touched.

The BC660K-GL makes this possible because extended DRX power drain is extremely low and PSM results in less than a µA of current consumption. In fact, current consumption is 800 nA and depending on the usage cycle, daily consumption can be anywhere between 5 and 20 µA. These are extremely efficient levels at which a typical MCU would go into a deep sleep. This makes the BC660K-GL an extremely powerful module for the smart metering market.

In addition, the cost structure of the BC660K-GL is highly attractive and makes it possible to compete with proprietary deployments like RF mesh, WiSun and even non-cellular LPWA technologies like Sigfox and LoRa, for example. For those looking to regional and global deployment, this module supports global bands and Quectel is committed to completing certification from mainstream global carriers.

The BC660K-GL is a high-performance LTE Cat NB2 module which supports multiple frequency bands with extremely low power consumption. The module’s ultra-compact size of 17,7 x 15,8 x 2,0 mm makes it an ideal choice for size-sensitive applications. Designed to be compatible with Quectel’s GSM/GPRS M66 module and NB-IoT BC66 module in form and size, it provides a flexible and scalable platform for migrating from GSM/GPRS to NB-IoT networks.

From an installation point of view, the BC660K-GL adopts surface-mount technology, which makes it well suited for durable and rugged designs. The module’s small LCC package allows it to be easily embedded into space-constrained applications and to enjoy reliable connection with the applications. This kind of package suits large-scale manufacturing which has strict requirements on cost and efficiency.

Due to its ultra-compact size, super-low power consumption and extended temperature range, the BC660K-GL is one of the best choices for smart metering and it is able to provide a complete range of SMS and data transmission services to meet various user demands.

Conclusion: future-ready implementations

The investments being made in smart meter infrastructure set the scene for the meter to become an in-building and home hub for other appliances to utilise to enable data transmission and a range of applications. Smart meters can provide a service platform for appliances such as dishwashers, fridges, smoke detectors and access control, many of which will become managed services. There is a clear intent among utilities companies to play themselves into this arena, building on their smart metering infrastructure.

Revenues from other service providers will help offset their investments here but in order to play, metering companies will need to have the additional network capacity and battery power available to support other partners’ business cases. This is why specifying a powerful module such as the BC660K-GL is such an important

strategic move.

Failure to select modules that don’t offer the low cost, low power and long-life attributes of the BC660K-GL can mean smart meters will not be able to support additional services and new revenue opportunities are lost. The only other alternative then is a costly upgrade cycle to replace or improve the existing deployed base of smart meters. Few business cases can withstand that so, to be future-ready, a module with the capabilities of the BC660K-GL is a prerequisite.

| Tel: | +27 11 781 2029 |

| Email: | [email protected] |

| www: | www.icorptechnologies.co.za |

| Articles: | More information and articles about iCorp Technologies |

© Technews Publishing (Pty) Ltd | All Rights Reserved