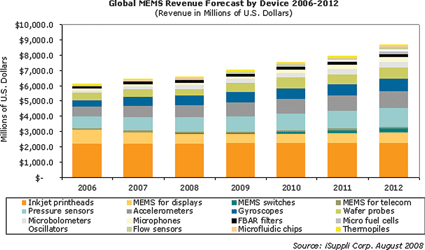

Driven by new demand from consumer electronics and wireless applications, the global market for micro-electromechanical systems (MEMS) will expand to $8,8 billion in 2012, up from $6,1 billion in 2006, iSuppli predicts.

“The markets for mainstay MEMS actuator products, like inkjet heads and digital light processor (DLP) chips from Texas Instruments, have finally passed the baton to MEMS sensors to drive the next growth wave in the market,” said Jérémie Bouchaud, director and principal analyst, MEMS. “The new wave is partly founded in the rapid rise of consumer electronics applications such as motion sensors for gaming, laptops and digital still cameras. Mobile handsets will also be a strong area, with MEMS sensor revenue in this area to rise at a 22,9% compound annual growth rate to reach $925 million in 2012.”

The attached figure presents iSuppli’s forecast of global MEMS revenue by device.

The worldwide market for accelerometers, gyroscopes, microphones, pressure sensors, bulk acoustic wave (BAW) filters, flow sensors, micro-fluidic chips, microbolometers, thermopiles and oscillators is growing at an 11% rate annually, and overtook the actuator market for the first time ever in 2007.

Four main segments collectively will account for slightly more than 60% of total MEMS market revenue in 2012: consumer electronics, mobile handsets, automotive and industrial process control. Aside from the consumer and wireless applications, market pull is being exerted by the automotive sector, an established area set to receive new impetus as a result of mandates for safety and new emissions standards. Demand will also be driven by a diverse range of applications in industrial processing and control.

The one bright spot for actuators is in radio frequency (RF) MEMS switches used in mobile handsets and test equipment. This market will grow at an annual rate of more than 100% from 2006 to 2012, and will account for $261 million in actuator revenue in 2012, up from just $6 million in 2007.

“The consumer electronics and mobile communications fields are much more dynamic than the previous mainstay markets for MEMS, ie, inkjet heads, diverse industrial applications and automotive uses,” Bouchaud said. “Existing companies have a great opportunity to ride this wave and new players have a chance to address a relatively open market. However, deep R&D pockets are essential to compete in this area, and the companies that will succeed will be those that bet on and invest in building dedicated mass-production facilities.”

Pioneering companies with brand new MEMS products tend to enjoy a lengthy monopoly in the market, such as Texas Instruments with its DLP chip or Knowles with MEMS microphones.

Meanwhile, in fast-moving markets like consumer electronics and automotive sensors (the latter driven by mandates), economies of scale will be the norm, with sensor companies attempting to address both sectors. iSuppli also expects the pace of mergers and acquisitions to accelerate in 2008 and 2009, concentrating MEMS market share among fewer players.

For more information visit www.isuppli.com.

© Technews Publishing (Pty) Ltd | All Rights Reserved