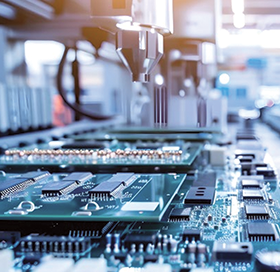

Electronics manufacturing is the most globally interconnected industry in the world. Trade in electronics inputs and finished goods has reached $4,5 trillion, representing more than 20% of global merchandise trade. Behind every smartphone, laptop, or server lies a web of international transactions involving semiconductors, batteries, connectors, printed circuit boards, and hundreds of other components. While many discussions focus on where a product is assembled, this report emphasises the critical importance of where it begins; where components are made, sourced, and moved.

Electronic components and inputs now drive more trade than finished goods:

• In 2023, global trade in electronic components exceeded finished electronics by over $408 billion.

• As products become more complex and modular, the number and value of globally sourced components continue to grow.

• Inputs now represent the majority share of electronics trade, making upstream supply chains the critical locus of strategic control.

China remains the largest supplier of finished electronics, with $622 billion in shipments in 2023, accounting for roughly 30% of global trade in this category. Yet its dominance is slipping. Between 2017 and 2023, China’s share of global finished electronics trade dropped by 4,6 percentage points, and its portion of US electronics sourcing fell from 47% to 27%.

At the same time, China is a global hub for components. It supplies 38% of Europe’s electronics input imports, up from 30% in 2017, and plays a key upstream role in production for Vietnam, India, and other fast-growing markets. In 2023, China imported $630 billion in components, more than the US, EU, and Singapore combined, underscoring its dual leading role as both buyer and seller in global electronics value chains.

Global electronics producers rely on global inputs

Vietnam and India have rapidly emerged as key suppliers in the global electronics supply chain. Between 2017 and 2023, Vietnam’s electronics exports rose by $48 billion, a 74% increase, and India’s surged from under $6 billion to over $28 billion, a 380% rise. Despite this growth, neither country has built self-sufficient supply chains. Both depend heavily on imported components from China, the Taiwan region, and Republic of Korea. For example, India’s input imports rose by 122% and Vietnam’s by 83% during that period, showing that their export capacity is powered by global sourcing.

US and EU: Divergent paths on China

Following its imposition of tariffs on China in 2018, the US sharply reduced electronics imports from China, shifting $49 billion in sourcing to countries like Vietnam and Mexico. Vietnam’s share of US finished electronics imports rose from 2,6% to 10% between 2017 and 2023.

In contrast, the EU increased its reliance on China. EU electronics imports from China rose by $43 billion over the same period, and China now supplies nearly half of all EU finished electronics.

Intra-Asian trade: The foundation of global electronics

Asia has become the undisputed hub of global electronics manufacturing and trade. In 2023, Asian countries imported nearly $1,6 trillion in electronics from within the region. About 90% of imported components and 74% of imported finished electronics in Asia came from other Asian economies. More than three-quarters of intra-Asian electronics trade is in components, highlighting the region’s dense, input-driven supply network.

Strategic implications for industry and policymakers

For industry: Electronics firms must prioritise supply chain design, emphasising diversified sourcing from strategic partners, enhancing regional industrial strategies, and planning for potential risks. Resilience comes not from isolation but from flexibility and intelligent management of global networks.

For policymakers: Full decoupling is economically unrealistic. No single country can replicate the multi-nation value chain behind modern electronics. Governments should invest in domestic strengths, coordinate with international partners, and align trade and industrial policy with the realities of a globally connected electronics sector.

For more information visit www.electronics.org

© Technews Publishing (Pty) Ltd | All Rights Reserved